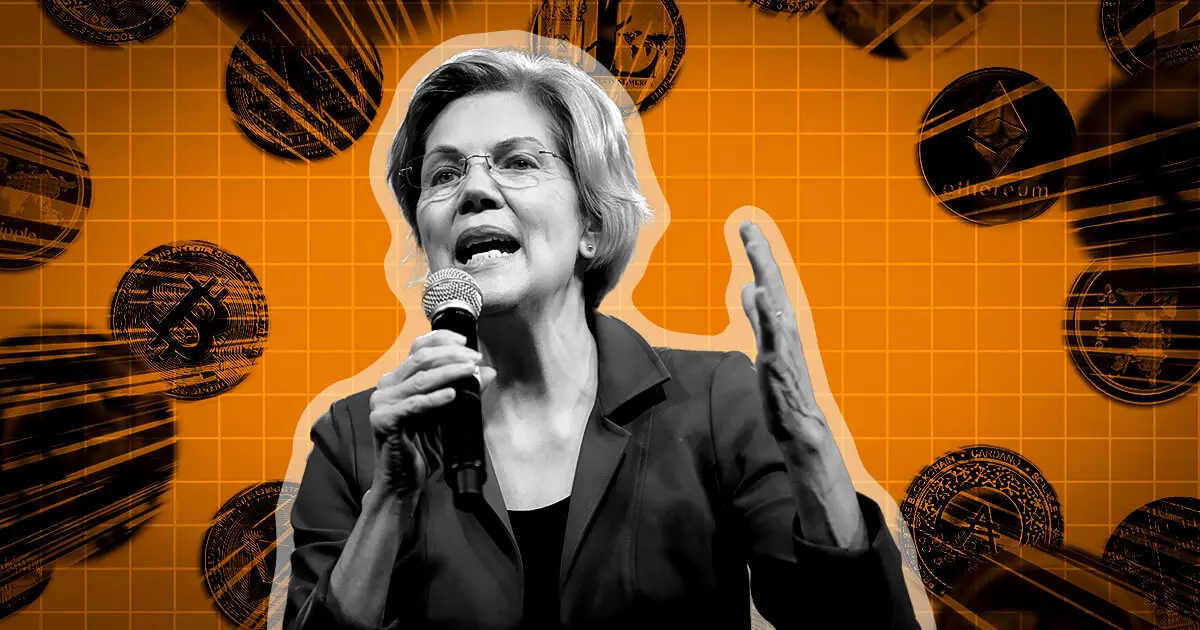

US Senators, led by Elizabeth Warren, have written a letter to Treasury Secretary Janet Yellen and IRS Commissioner Daniel Werfel, urging them to take prompt action in implementing new tax reporting requirements for digital asset brokers. This call for action is based on the Infrastructure Investment and Jobs Act (IIJA), a bipartisan measure enacted nearly two years ago to address the estimated $50 billion crypto tax gap and streamline the process for reporting crypto income.

The Need for Timely Implementation

According to the letter, Congress directed the Treasury Department and the IRS to finalize new rules by January 1, 2024. However, with less than six months remaining until the deadline, the agencies have yet to publish proposed rules. The Senators raised concerns about the potential failure to meet these deadlines and emphasized the necessity of robust tax reporting rules for cryptocurrency brokers.

The Impact of the IIJA

The IIJA was initially enacted when the US faced a $1 trillion tax gap, with the $2 trillion cryptocurrency sector playing a role in exacerbating the issue. The new rules introduced by the IIJA have profound implications for the crypto ecosystem. They require third-party brokers facilitating crypto transactions to report information to the IRS regarding users’ crypto sales, gains or losses, and certain large transactions. This move aims to simplify the tax filing process for crypto users and enhance the IRS’s ability to tackle tax evasion.

The Senators highlight that the implementation of these rules is of utmost importance. They project that failure to meet the December 31, 2023 deadline could result in a loss of an estimated $1.5 billion in tax revenue in 2024 alone. These rules are expected to generate approximately $1.5 billion in tax revenue in 2024 and close to $28 billion over the next eight years.

A Stringent Regulatory Landscape

This development occurs alongside Wall Street banks supporting Elizabeth Warren’s Digital Asset Anti-Money Laundering Act, which aims to impose bank-like standards and requirements on crypto businesses. It is evident that the regulatory landscape for the crypto industry in the US is becoming more stringent, with an increasing focus on traceability, oversight, and visibility.

The Senators’ letter emphasizes the urgent need for the implementation of tax reporting rules for digital asset brokers. The IIJA seeks to address the crypto tax gap and enhance tax reporting practices. The projected revenue from these rules highlights their potential impact. The regulatory environment for the crypto industry in the US is undergoing significant changes, underscoring the importance of compliance and transparency.

Leave a Reply