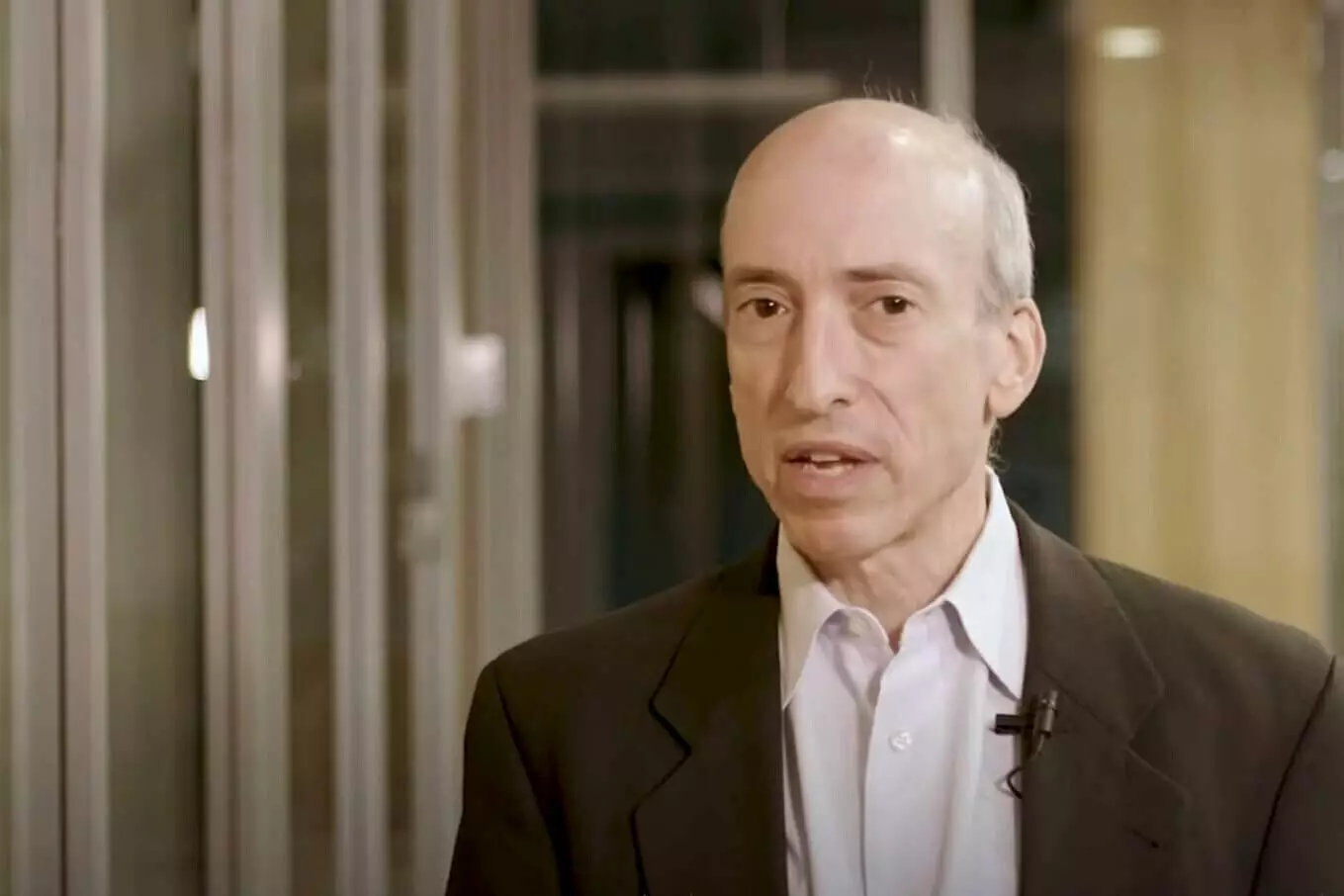

The Securities and Exchange Commission (SEC) chair, Gary Gensler, has voiced his disappointment regarding a recent court ruling that declared Ripple’s XRP token as “not in and of itself” a security. While speaking at an event hosted by the National Press Club in Washington DC, Gensler expressed his displeasure on behalf of retail investors while acknowledging his satisfaction with the protection of institutional investors provided by the ruling.

The Court’s Ruling on XRP

The court ruling stated that XRP should not automatically be considered an “investment contract” or security. Instead, it emphasized that the classification of the XRP token depends on the specific context in which it is used. Furthermore, the ruling clarified that Ripple’s “programmatic” sales of XRP, which involve the use of trading algorithms to sell tokens on exchanges, do not constitute a securities offering.

Continued Focus on Cleaning up the Crypto Sector

Despite the court ruling, Gensler emphasized that the SEC’s efforts to regulate and clean up the cryptocurrency sector in the United States will persist. He stated that the SEC will strive to bring non-compliant firms into compliance without making any prejudgments. The primary goal remains the protection of the investing public.

Case Referral to Magistrate Judge

On the same day as Gensler’s comments, the remaining issues in the ongoing legal battle between Ripple and the SEC were referred to Magistrate Judge Sarah Netburn. It is worth noting that Judge Netburn previously ordered the unsealing of the Hinman documents, which played a significant role in Ripple’s favorable ruling.

Despite expressing disappointment in the court ruling, SEC Chair Gary Gensler remains focused on protecting investors and ensuring compliance within the cryptocurrency industry. The ruling clarified the contextual nature of the XRP token’s classification and emphasized that Ripple’s sales of XRP do not constitute a securities offering. As the legal battle continues, the involvement of Magistrate Judge Sarah Netburn adds an interesting dimension to the case. The regulatory landscape for cryptocurrencies will undoubtedly evolve in the coming months as regulators and industry participants navigate the complexities of this rapidly growing sector.

Leave a Reply