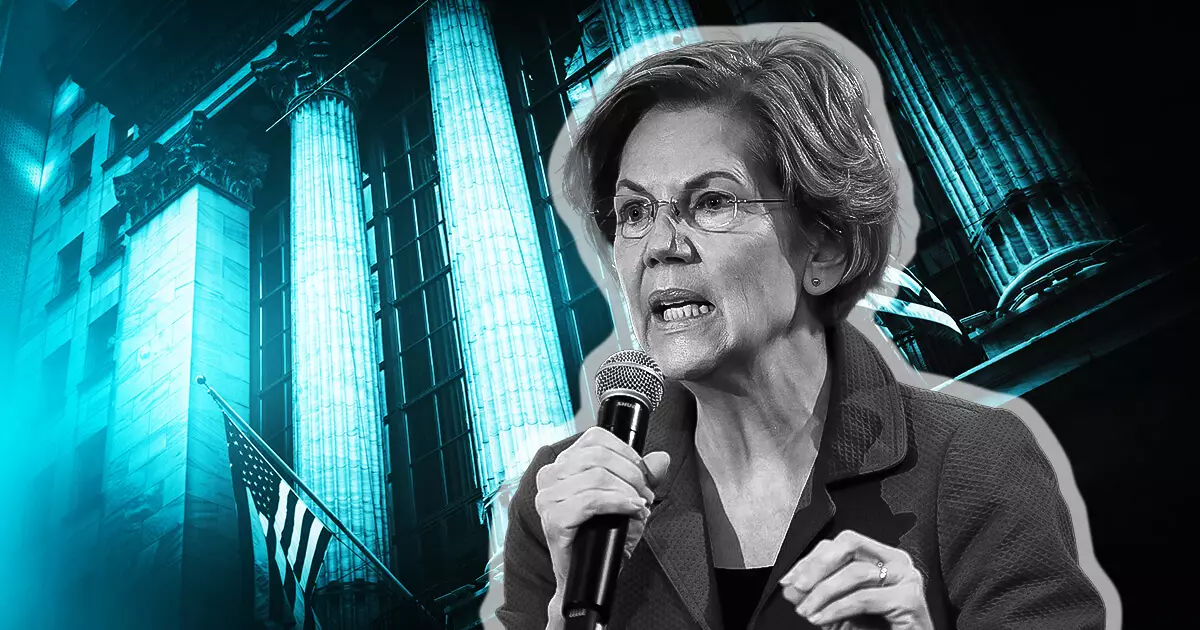

U.S. Senator Elizabeth Warren has gathered unlikely allies in her reintroduction of the Digital Asset Anti-Money Laundering Act on July 28. The legislation, focusing on mitigating national security risks associated with cryptocurrencies, has garnered support from the Wall Street banks. This surprising alliance signifies a common understanding of the need to crack down on crypto.

Warren, who historically criticized the Wall Street banks as a fervent critic of The Bank Policy Institute, emphasizes that cryptocurrencies have become the favored payment method among cybercriminals. In a press release, she states that the bipartisan bill she proposed is the most robust approach to combatting crypto crime and equipping regulators with the necessary tools to prevent the flow of cryptocurrency to bad actors.

Imposing Obligations on Crypto Industry

Originally introduced in December 2022, the 7-page bill aims to impose the obligations set forth by the Bank Secrecy Act (BSA) on various entities within the crypto industry. These include crypto wallet providers, miners, validators, and service providers. If passed, they will need to meet know-your-customer requirements.

Compliance Examination and Review Process

The bill mandates the Treasury Department to establish a compliance examination and review process. This process aims to ensure that all crypto money service businesses comply with anti-money laundering and countering the financing of terrorism (AML/CFT) obligations under the BSA. The legislation also calls for the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to implement similar review processes for crypto businesses within their jurisdiction.

In addition, the bill requires crypto businesses to file a Report of Foreign Bank and Financial Accounts (FBAR) with the Internal Revenue Service. This report is mandatory whenever a U.S. customer conducts crypto transactions over $10,000 using offshore accounts.

The bill also addresses self-custody wallets, aiming to close the regulatory gap associated with them. The Financial Crimes Enforcement Network (FinCEN) is directed to implement a previously proposed rule from 2020. This rule will make it compulsory for banks and money service businesses to verify customer and counterparty identities, maintain records, and file reports for specific crypto transactions involving self-custody wallets or wallets hosted in non-compliant jurisdictions.

To tackle risks associated with crypto ATMs, the bill requires FinCEN to ensure that ATM owners and administrators regularly report and update the physical addresses of their kiosks. Operators must also verify customer and counterparty identities for all transactions.

Furthermore, the bill directs FinCEN to provide guidance to financial institutions on mitigating risks when handling, using, or transacting with crypto that has obscured origin through mixers or other anonymity-enhancing technologies.

The overarching goal of the bill is to subject crypto businesses to similar regulations as banks. Senator Roger Marshall, a supporter of the bill, highlights that the outlined reforms will enable the fight against digital asset security threats by employing proven methods that domestic financial institutions have adhered to for years. Senator Lindsey Graham, another backer, emphasizes that many of the rules governing the dollar should also apply to cryptocurrencies.

Senator Elizabeth Warren’s reintroduction of the Digital Asset Anti-Money Laundering Act, with the surprising support of Wall Street banks, reflects a united front in recognizing the necessity to address the challenges posed by cryptocurrencies. The bill seeks to subject the crypto industry to stringent regulations, ensuring compliance with anti-money laundering measures and countering the financing of terrorism. If enacted, this legislation will establish greater security in the digital asset landscape.

Leave a Reply